This Insight is part of our Medicare Payment Primers series.

Medicare covers eligible services for homebound beneficiaries in need of part-time or intermittent skilled services including skilled nursing care; physical, occupational, and speech-language pathology services; medical social services; home health aide care; and medical supplies used in the home (collectively, “Home Health Services”) furnished by Medicare-certified home health agencies (HHAs). A beneficiary qualifies as homebound only if his or her physician or practitioner certifies the beneficiary would have difficulty leaving the home without help due to illness or injury; that leaving the home is not recommended due to the patient’s condition; or that leaving the home would require a major effort on the part of the beneficiary.

Discussion

Base Rate

HHAs are reimbursed for Home Health Services under the home health prospective payment system (HH PPS) based on a national, standardized 30-day period payment rate (Base Rate). The Base Rate is updated on an annual basis to reflect the change in the cost of goods and services used by HHAs from one year to the next. This annual adjustment to the Base Rate is referred to as the market basket update.

The Base Rate does not reimburse HHAs for durable medical equipment (DME) furnished to a homebound beneficiary. Instead, DME is paid through the DME fee schedule or the competitive bidding program.

If a beneficiary remains homebound and still requires Home Health Services at the end of the initial 30-day period, another period commences with a resultant additional Medicare payment.

The actual amount an HHA receives as payment for Home Health Services furnished to a specific Medicare beneficiary is calculated based on facility-specific and patient/case-specific adjustments to the Base Rate.

Facility-Specific Adjustments

Differences in Area Wages: The HH PPS uses the same area wage index established for a market under the inpatient prospective payment system (IPPS), excluding any adjustments due to geographic reclassification or the rural floor. (See our article, Medicare Payment Primers: The Fundamentals of Prospective Payment System, for additional information.) The Base Rate is divided into a labor-related amount and a non-labor-related amount. Note that the wage index used to adjust the labor portion of the Base Rate is based on the geographic location where the services are rendered, not where the HHA is located.

Home Health Quality Reporting Program (QRP): HHAs must submit quality measures, resource use data, and other measures using the Outcome and Assessment Information Set (OASIS) assessment instrument. HHAs must submit admission and discharge OASIS assessments for at least 90% of patients receiving care during the reporting period to avoid a 2 percentage point annual market basket update reduction.

Home Health Value-Based Purchasing Model (HHVBP): Under HHVBP, an HHA’s Base Rate is adjusted based on its performance on a set of quality measures as compared to its peers. Peer cohorts are determined based on each HHA’s unique beneficiary count in the prior calendar year. An HHA is assigned to either a nationwide larger-volume cohort or a nationwide smaller-volume cohort. An HHA’s score during a given performance year will impact its payments two years thereafter (e.g., 2023 performance will impact 2025 payments).

Read details regarding HHVBP measures.

Patient/Case-Specific Adjustments

Patient-Driven Groupings Model (PDGM): After making facility-specific adjustments to the Base Rate, the next step is to adjust payment for each 30-day period of care to reflect the beneficiary’s health conditions and care needs.

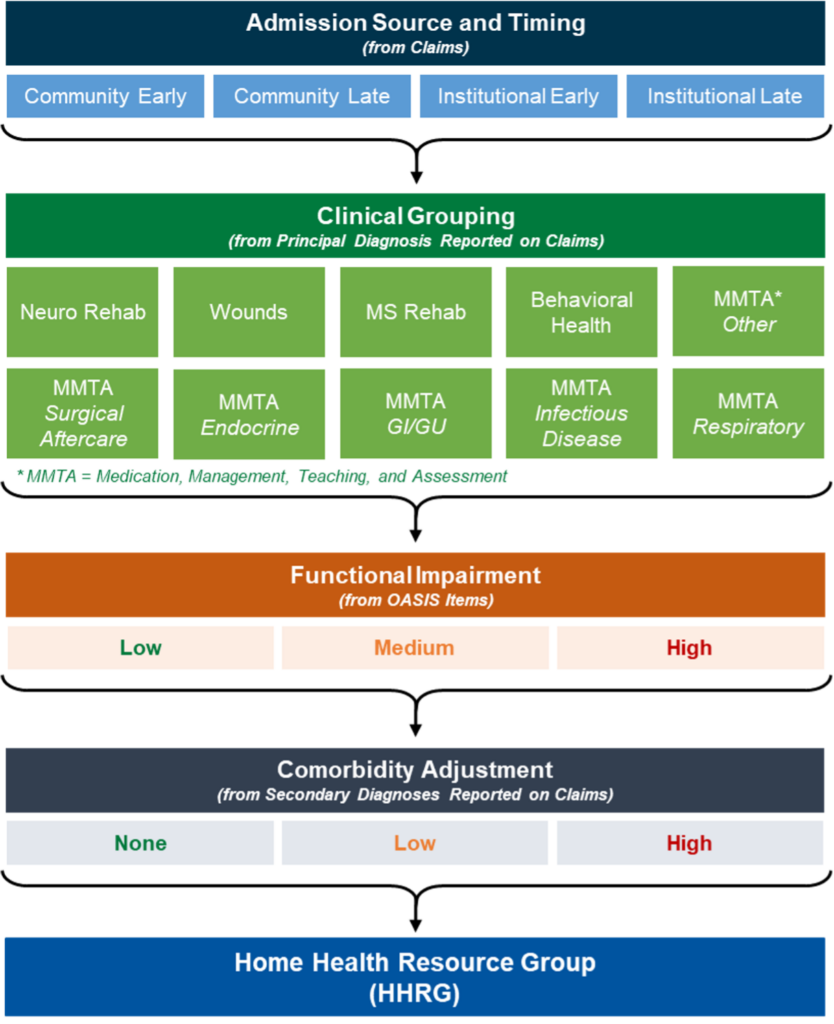

First, 30-day periods are grouped by admission source and timing:

- Admission source

- Institutional: inpatient acute care hospitals or post-acute such as skilled nursing, inpatient rehabilitation, long-term care hospital, or inpatient psychiatric facility care in the 14 days prior to the home health admission

- Community: no acute or post-acute care in the 14 days prior to the home health admission

- Timing

- Early: the first 30-day period in a sequence of home health periods

- Late: second and subsequent 30-day periods in a sequence of home health periods

Next, the principal diagnosis reported on the home health claim assigns the 30-day period to a clinical group that explains the primary reason the patient is receiving Home Health Services. Payment varies among each of the clinical groups to account for the differences in resource use associated with the primary reason for care. Reported secondary diagnoses (comorbidities) also impact the case-mix adjustment methodology. HHAs can report up to 24 secondary diagnoses that may be eligible for additional payment under PDGM.

Finally, PDGM designates a functional impairment level for each 30-day period based on responses to certain OASIS items such as bathing, grooming, risk of hospitalization, and ambulation. Responses that indicate higher functional impairment and a greater risk of hospitalization are associated with higher resource use and are therefore assigned higher points. These points are then summed, and thresholds are applied to determine whether a 30-day period is assigned a low, medium, or high functional impairment level.

Under PDGM, a 30-day episode of care is grouped into one subcategory under one of the four major categories (i.e., admission source and timing, clinical grouping, functional impairment level, and comorbidity adjustment). A 30-day period’s combination of subcategories places that period into one of 432 different payment groups, called Home Health Resource Groups (HHRGs). Each HHRG’s case-mix weight reflects predicted mean group cost relative to the overall average across all groups.

Low-Utilization Payment Adjustment (LUPA): A 30-day period with few in-person visits are paid a per-visit payment rate, rather than the case-mix adjusted HHRG rate. The threshold for a period to qualify as a LUPA varies from 2-6 in-person visits, depending on the HHRG to which a period has been assigned.

Partial Period Payments: Home health payments are adjusted when a beneficiary transfers from one HHA to another or is discharged and readmitted to the same agency within 30 days of the original 30-day period start date. The case-mix adjusted payment for the 30-day period is prorated based on the length of the partial 30-day period that ends with the transfer or discharge and readmission, resulting in partial period payments.

Outliers: Additional payments are made to HHAs for those patients who incur unusually high costs. Outlier payments are made for periods of care where imputed cost exceeds a threshold amount for each case-mix group. The amount of the cost outlier payment is a proportion of the amount of imputed costs beyond the threshold. Outlier costs are imputed for each period of care by applying standard per-visit amounts to the number of visits by discipline reported on the claims. The outlier threshold is established annually at a rate that allows outlier payments to be no more than 2.5% of the estimated total payments under HH PPS.

Rural Add-On Payments: The Balanced Budget Act of 1997 provided a rural add-on payment for episodes of care ending in CY 2022. The Consolidated Appropriations Act, 2023 extended the policy for CY 2023 by providing an increase of 1% of the payment amount for services provided in low population density areas (i.e., rural counties and equivalent areas having six individuals or fewer per square mile). Any extension beyond CY 2023 would require Congressional action.

Resources

Centers for Medicare & Medicaid Services Home Health PPS

MLN Matters® Overview of the Patient-Driven Groupings Model

This Insight is part of our Medicare Payment Primers Series. If you have questions about reimbursement, strategy and transactions, compliance, or valuation, one of our executive contacts would be happy to assist. You may e-mail them below or call (800) 270-9629.