In early December 2020, the Centers for Medicare & Medicaid Services (CMS) finalized plans to launch the mandatory Radiation Oncology (RO) Model on July 1, 2021. Later that month, however, Congress stepped in to delay the start date to January 1, 2022.

CMS used the additional time to fine-tune this episodic payment model. This summer, the agency released the 2022 Medicare Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System (OPPS/ASC) Proposed Rule, which includes several modifications to the RO Model.

The following table summarizes the proposed changes. CMS will issue the Final Rule in November or December, just weeks before the RO Model’s January 1, 2022, launch date. Now is the time to prepare for success under this mandatory payment model if your organization is impacted.

| Topic/Category | December 2020 Final OPPS/ASC Rule | UPDATED – July 2021 Proposed OPPS/ASC Rule |

| Performance Years (PY) | July 1, 2021 (PY1) – December 31, 2025 (PY4) | January 1, 2022 (PY1) – December 31, 2026 (PY5) |

| RO Model Exclusion | Hospital Outpatient Departments (HOPDs) participating in or eligible for the Pennsylvania Rural Health Model (PARHM) are excluded | Participants in the Community Transformation track of the Community Health Access and Rural Transformation (CHART) Model, or PARHM are excluded |

| Low-Volume Opt-Out Criteria | Entities may opt out for a given PY if they have <20 episodes or RO episodes (depending on the PY) across all CBSAs[1] selected for participation in the most recent year with claims data available (2 years prior to the applicable PY) | Additionally, a new TIN or CCN[2] is not eligible for opt-out if the combined current and legacy entities involved furnished 20 or more radiation therapy service episodes across all participating CBSAs in the most recent full year with claims data available prior to the applicable PY |

| National Base Rate Calculation Period | 2016-2018 | 2017-2019 (3 years prior to PY1) |

| Case Mix and Historical Experience Adjustment Calculations | CMS will use current TIN or CCN | CMS will use current and legacy TIN or CCN |

| Cancer Type Inclusion | 16 cancer types included | Liver cancer removed, and inclusion criteria adjusted |

| Modality Inclusion | Brachytherapy included | Brachytherapy removed from the list of included modalities |

| Discount Factor | Professional: 3.75%, Technical: 4.75% | Professional: 3.5%, Technical: 4.5% |

| Payment Amount Subject to Withholds | Quality: 0% of Professional Component (PC) for PY1

Incorrect payments: 1% of PC and 1% of Technical Component (TC) Patient Experience: 1% of TC starting PY3 |

Quality: 2% of PC

No change to incorrect payments or patient experience |

| Sequestration Language | 2% sequestration from each episode payment | 2% deduction for sequestration amended to indicate “sequestration will be applied in accordance with applicable law” |

| Qualify as Advanced Alternative Payment Model Under Quality Payment Program | PY2 (2022) | PY1 (2022) |

| Alternative Payment Model (APM) or Merit-Based Incentive Payment System (MIPS) Qualifications Updates | Participants have an opportunity to be eligible for Qualifying APM Participant (QP) or partial QP status based on meeting a relevant QP threshold payment amount or patient count, and are exempt from MIPS reporting requirements and payment adjustment for the relevant year; those that do not meet the RO Model requirements would not be eligible for Advanced APM payments | Track One: Dual and Professional participants that meet RO Model requirements, including the definition of eligible clinicians and Certified EHR Technology (CEHRT) use, are eligible for QP determination if they meet the QP threshold; those that do not meet the threshold are eligible for APM scoring in MIPS

Track Two: Dual and Professional participants who fail to meet RO model and monitoring requirements, and all Technical participants, are not eligible for QP determination |

| CEHRT Use Attestation | Begin in PY2 | 30 days prior to PY1 (January 1, 2022) |

| Quality Measure Data | Delay until PY2; submit PY2 in PY3 (March 2023) | No delay; submit PY1 data in PY2 (March 2023) |

| Quality Measure Model Pay for Reporting (PFR) and Pay for Performance (PFP) Periods | PFP and PFR do not start until PY2 | Three measures (Pain Plan of Care, Preventive Care and Screening, and Advanced Care Plan): PFP in PY 1-5

Treatment Summary Communication measure: PFR PY1-2 and PFP for PY3-5 Patient Experience measures in PY3 |

| Consumer Assessment of Healthcare Providers & Systems (CAHPS) Cancer Care Survey (For Patient Experience Measures) | Administered October 2021 | Administered PY1 in April 2022 |

| Individual Practitioner List (IPL) Review and Certification | Participant must notify CMS of changes to IPL within 30 days of receiving the List | Participant must notify CMS of changes to IPL by the Quality Payment Program snapshot date (30 days prior to PY) |

| Clinical Data Collection Period | Delay until PY2; submit PY2 Jan-Jun 2022 data in July 2022 | Submit PY1 Jan-Jun data in July 2022 |

| Incomplete Episodes Payment | When traditional Medicare ceases to be the primary payer during treatment, the participant is reimbursed only for the first episode installment | For all incomplete episodes where coverage changed during the treatment episode, CMS will reimburse with what fee-for-service rates would have been for those radiation therapy services using no-pay claims |

| Reconciliation Payments | Reconciliation calculations for all PYs will occur in August after the end of each PY (i.e., initial reconciliation for PY1 will occur in August of PY2 with reconciliation true-up payments in August of PY3); however, quality payments will not be applicable for PY1 | Reconciliation calculations and true-up payment time periods are unchanged; however, quality payments are included in all PYs |

| Extreme and Uncontrollable Circumstances Policy | N/A | CMS may adjust or waive the performance period, reporting requirements, or pricing methodology, in the event of extreme circumstances |

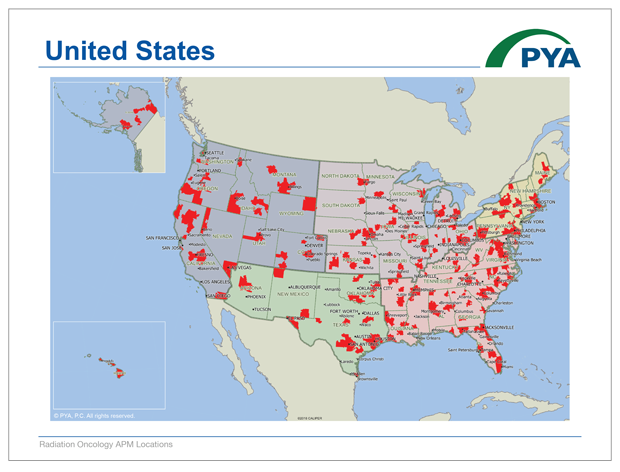

CMS does not propose to change the list of zip codes defining the geographic areas in which the RO Model applies. PYA has converted those zip codes into an interactive map below to illustrate the reach of the RO Model.

Click Below to View the PDF Map:

View the Google Map Below (load times vary):

- Establish a task force of key individuals responsible for staying current on program requirements, managing implementation of any care delivery model changes, collecting and submitting quality measures and clinical data, and addressing the impact on revenue cycle and financial performance.

- Calculate how your current average Medicare reimbursement rate per episode of care compares to RO model rates for the included 15 tumor sites. If your reimbursement is likely to be lower, now is the time to identify opportunities for improvement. For example, consider implementing hypofractionation more consistently for appropriate patients and/or integrating remote patient monitoring to streamline staff utilization.

- Assess your current performance on CMS’ selected quality and reporting metrics, and identify and implement solutions to improve these outcomes.

- Develop and maintain collaborative relationships with providers across the cancer continuum of care by setting common goals and pursuing initiatives to achieve optimum performance under the RO Model.

- Consider pursuing new business models that may better align the hospital and physicians toward common objectives for the RO Model. These may range from integration into a hospital clinically integrated network, medical directorships, or co-management agreements, to professional services agreements or even employment models.

With our deep understanding of the RO Model and wealth of experience helping oncology programs, PYA is here to support your success under this new payment model. For assistance, contact a PYA executive below at (800) 270-9629.

[1] CBSAs- Core-Based Statistical Areas

[2] TIN- Tax ID Number; CCN- CMS Certification Number