To quote an old song, “There’s a new kid in town.” This “new kid,” though, has already been around the block, and is being reintroduced in 2020 for business and individual 1099 filing needs.

The new kid is Form 1099-NEC for reporting Nonemployee Compensation. Form 1099-NEC was retired in 1983, and Form 1099-MISC was used to report independent contractor payments, also known as nonemployee compensation. Early in 2019, the government decided to return to Form 1099-NEC reporting for 2020. According to CPA Practice Advisor, “The 1099-NEC is being reintroduced to address confusion created by the PATH (Protecting Americans from Tax Hikes) Act of 2015.” The PATH Act created different due dates for the various types of income reported on Form 1099-MISC, leading to confusion for filers and potential penalties for late filings. Form 1099-NEC completely separates nonemployee compensation from Form 1099-MISC, creating a more streamlined resource for timely reporting of payments.

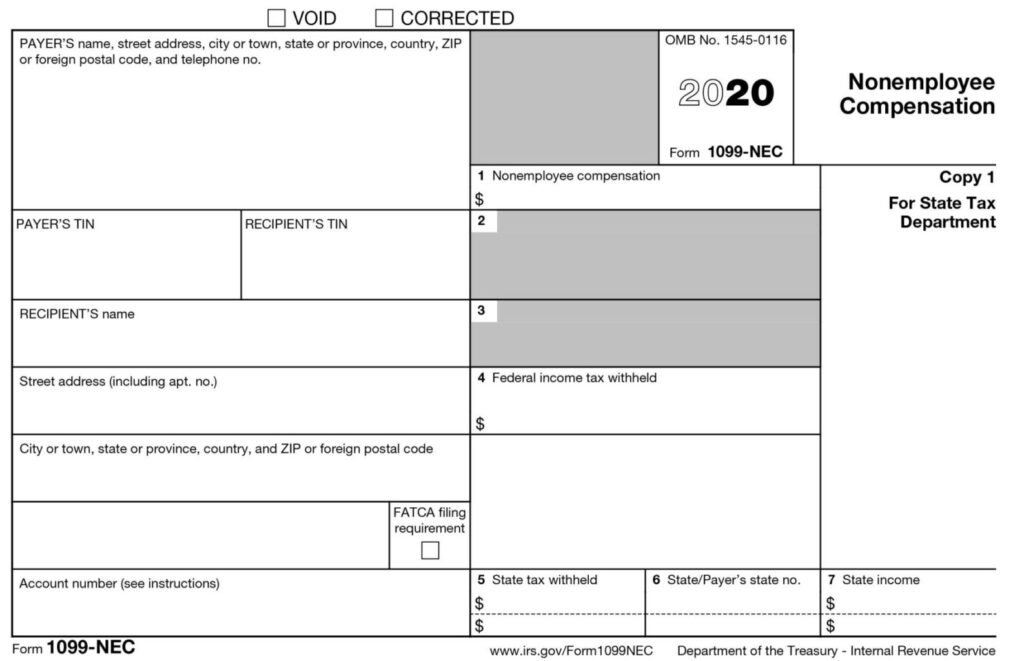

Form 1099-NEC (as seen below) is straightforward. Box 1 is for reporting nonemployee compensation, and Box 4 is to report any federal withholding in relation to the compensation. Boxes 5, 6, and 7 are for reporting state tax withheld, state ID numbers, and state income, respectively.

When to File Form 1099-NEC

Forms 1099-NEC must be filed with the IRS by January 31 of the year following the calendar year to which the return relates. For tax year 2020, the deadline is February 1, 2021, since January 31 falls on a Sunday. The deadline applies whether filing the form electronically or on paper.

Who Files Form 1099-NEC

The requirements for reporting nonemployee compensation have not changed, only the form on which it is reported. Services paid in excess of $600 to anyone who is not considered an employee must be reported as nonemployee compensation. Common examples of NEC include payments to independent contractors and laborers, fees paid for professional services such as attorneys and accountants, and nonemployee salesperson commissions that are subject to repayment, but not repaid during the calendar year. It is important to note that compensation paid to entities recognized as corporations does not need to be reported, but compensation paid to an individual attorney or law firm must be reported, regardless of whether the firm is a corporation.

A business may need to file both Form 1099-NEC and Form 1099-MISC to ensure proper reporting of all income. Items such as rent payments, royalties, and medical healthcare payments will still be reported on Form 1099-MISC. For tax year 2020, the deadline for filing 1099-MISC is February 28, 2021, if filing paper documents, and March 31, 2021, if filing electronically.

State Reporting

Unlike Form 1099-MISC, the IRS will not forward data to states for Form 1099-NEC. Businesses reporting state income will most likely need to use a vendor to file the form(s) electronically with the appropriate state reporting agencies, in addition to electronically filing with the IRS. Most states that support the filing of Form 1099-MISC have indicated they will require the filing of Form 1099-NEC.

The end of 2020 is quickly approaching. Now is the time for businesses to make sure their software and filing systems are up-to-date and all needed vendor information is current. For timely and correct filing, it is imperative that vendors be correctly identified in accounting software. A Form W-9 should also be on file for all vendors and contractors who will require a Form 1099-NEC or a Form 1099-MISC.

Full instructions for both Form 1099-NEC and Form 1099-MISC can be found on the IRS website.

If you have questions about either form, or would like assistance with tax preparation, planning, or submission, contact a PYA executive below at (800) 270-9629.