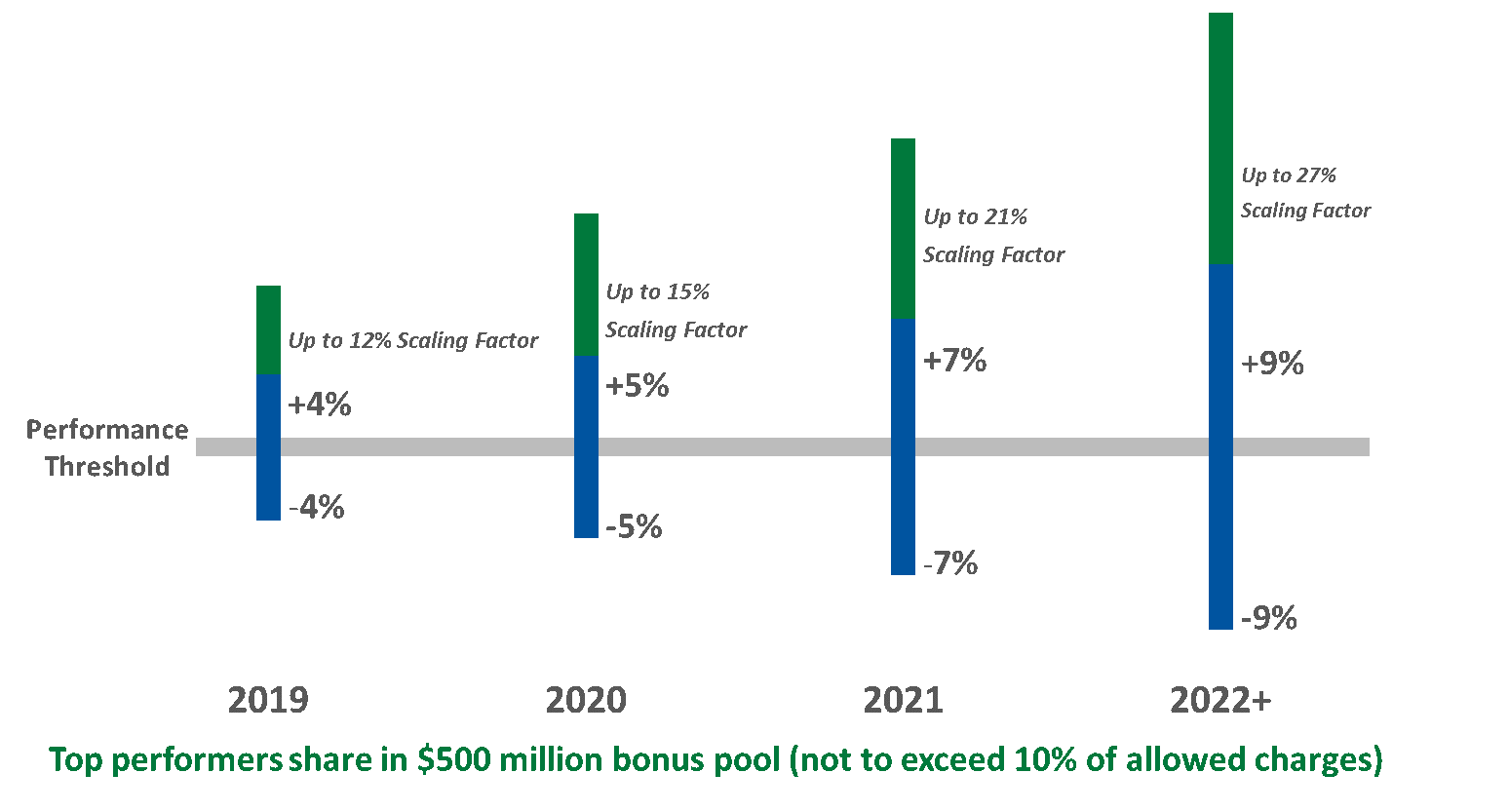

Almost every Merit-Based Incentive Payment System (MIPS) presentation includes a graphic like the one below illustrating upcoming payment adjustments of 4%, 5%, 7%, and eventually 9% on Medicare Part B payments, based on an eligible clinician’s performance on specified measures.

Due to changes enacted as part of the Bipartisan Budget Act of 2018, however, clinicians’ actual payment adjustments for the next few years will likely be a fraction of these amounts.

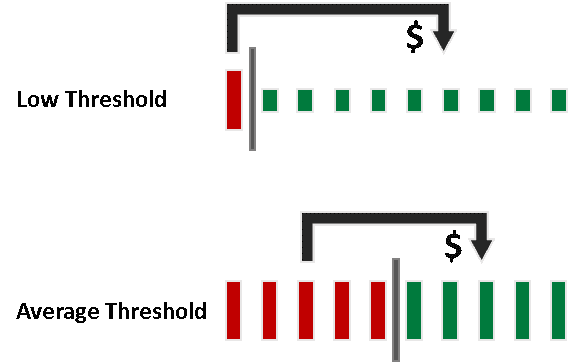

The Medicare Access and CHIP Reauthorization Act (MACRA) legislation that established MIPS made the program budget neutral: the total value of bonus payments paid to those clinicians scoring above the performance threshold must equal the total value of penalties assessed against those clinicians scoring below the threshold. When the threshold is set at average historical performance, there is a significant difference between the top performers’ bonuses and the poorest performers’ penalties.

For the 2017 and 2018 transition years, however, the Centers for Medicare & Medicaid Services (CMS) exercised its authority to set the thresholds significantly below the historical average. This means fewer clinicians will be penalized (thumbs up), but there will be far fewer dollars available for bonus payments.

In the 2018 Quality Payment Program Final Rule, CMS estimates that the average adjustment across all providers will be 0.9% in 2020 based on 2018 performance, and that no provider will receive more than a 2% bonus payment. These numbers include payments to clinicians from the $500 million exceptional performance pool, which is not funded by penalties. These projected bonus payments are merely a fraction of what providers expected to earn from MIPS performance improvement initiatives.

And Along Came the Bipartisan Budget Act of 2018

Under MACRA, CMS’ authority to keep the performance benchmark below the historical average was set to expire after 2018. However, in the Bipartisan Budget Act of 2018, Congress extended this authority through 2021. Now, CMS does not have to set the performance benchmark at the historical average until 2022:

“…the Secretary shall increase the performance threshold with respect to each of the third, fourth, and fifth years to which the MIPS applies to ensure a gradual and incremental transition to the performance threshold described in clause (i) (as estimated by the Secretary) with respect to the sixth year to which the MIPS applies.”

Assuming CMS keeps the benchmark low – and there’s no reason to believe the agency will do otherwise – the financial incentive to be a MIPS top performer will remain meager for the next several years.

Congress also clarified that MIPS adjustments apply only to Medicare Part B “covered professional services.” That means, most prominently, no MIPS payment adjustment for Part B drugs. Again, this lessens MIPS’ financial impact on eligible clinicians, both good and bad. It also means more clinicians will qualify for the low-volume exception, which further reduces the MIPS bonus pool.

Given this limited upside, as well as a number of competing priorities, clinicians may be tempted to ignore MIPS for now. However, there are two compelling reasons not to do so. First, a clinician who fails to meet minimum MIPS reporting requirements (which will become more demanding each year of the transition period) will be subject to the maximum penalty.

Second, CMS still is required to publish eligible clinicians’ performance scores on Physician Compare, and thus the potential reputational impact of MIPS remains intact. More than half-a-million clinicians’ scores will be publicly reported during 4Q 2018 for the 2017 performance year.

Finally, keep in mind the 5% bonus for qualifying participants in an advanced alternative payment model (APM) remains in place. For example, eligible clinicians participating in a Track 1+ Medicare Shared Savings Program ACO, which involves a relatively small level of risk, qualify for this bonus payment. Advanced APM participants also avoid MIPS reporting requirements and publication of their performance scores.

Given the ever-changing MIPS landscape, developing and executing a MIPS strategy can be frustrating, to say the least. PYA can assist your organization in understanding and evaluating options to be successful under pay-for-performance and other value-based reimbursement models.