While many provisions of the new Tax Cuts and Jobs Act (TCJA) overhaul the U.S. tax code, one in particular has potential implications for physician compensation. Specifically, Section 11048 (the Suspension of Exclusion for Qualified Moving Expense Reimbursement), which went into effect January 1, 2018, indicates that moving expenses may no longer be paid on a tax-free basis by an employer, including not-for-profit organizations such as hospitals and health systems, nor can the expenses be deducted by the employee if not paid for by the employer.1 Accordingly, if an employer pays for an employee’s move, any amounts paid are now included in taxable wages. When paid, these amounts are also subject to income tax withholding and Federal Insurance Contributions Act (FICA) and Medicare tax withholding.2 Relocation assistance is to be included in taxable wages, regardless of whether the employer pays a third-party moving service or reimburses an individual directly.

General Physician Relocation Allowance Amounts

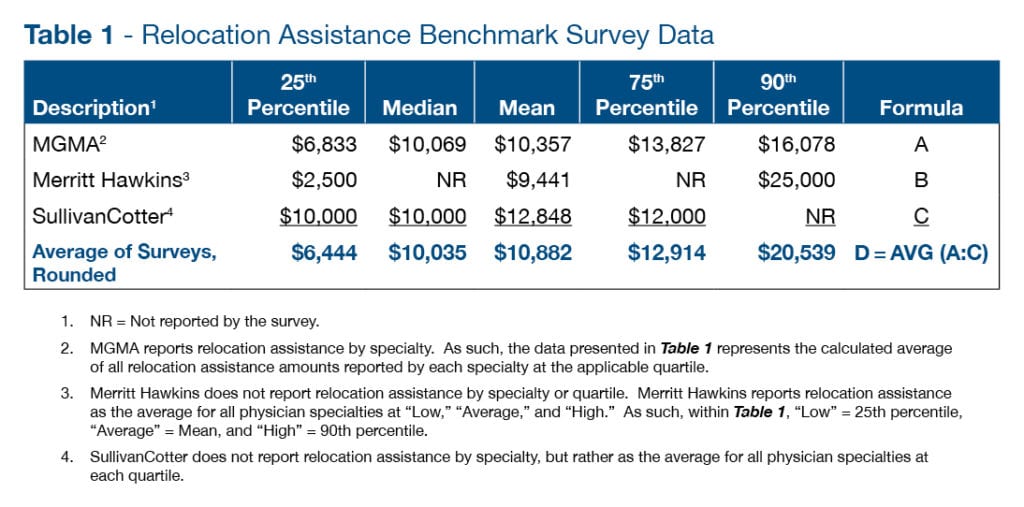

To appropriately plan for this change, it is important to understand the dollars associated with physician moving expenses paid by organizations, such as hospitals and health systems. Several benchmark survey resources report physician relocation assistance data, including, but not limited to:

- Medical Group Management Association (MGMA) 2018 DataDive Physician Placement Starting Salary Survey.3

- Merritt Hawkins 2018 Review of Physician and Advanced Practitioner Recruiting Incentives.4

- Sullivan, Cotter and Associates, Inc. (SullivanCotter) 2018 Physician Compensation and Productivity Survey Report.5

Based on information reported by these three surveys (as presented in Table 1), relocation assistance per physician ranges from approximately $6,444 at the 25th percentile to $20,539 at the 90th percentile.

Relocation Tax Reform: Potential Impact on Fair Market Value Compensation

As 2019 benchmark survey data becomes available for physician compensation— reported data generally lags one year, since 2019 benchmark survey resources report information from 2018—it may include applicable moving expenses a physician received (either paid directly to the physician or indirectly to a third-party moving service) that, prior to January 1, 2018, were excluded. As such, it is important hospitals and health systems understand this change in benchmark survey data, the potential impact on physician compensation, and whether this creates risk from a fair market value (FMV) perspective. As one example, if a physician is at the high end of the FMV compensation range, the addition of supplemental relocation assistance might cause the physician’s compensation to exceed FMV. Further, hospitals and health systems should consider performing a stacking analysis, whereby all of the disparate components of compensation paid to a physician—including relocation assistance stipends—are accumulated, to ensure the entirety of the physician’s compensation is still consistent with FMV, given the totality of services provided under the arrangement.

Conclusion

It is vitally important hospitals and health systems are mindful of changes to tax legislation, so they can appropriately plan for potential implications to their physician arrangements and avoid violations of federal laws prohibiting physician self-referral (Stark Law) and kickbacks (Anti-Kickback Statute).

PYA provides advice to clients on complex tax laws and related issues, while helping them minimize tax exposure and optimize savings. PYA also provides FMV compensation opinions for a wide range of financial arrangements entered into by physicians, hospitals, and other healthcare entities, helping to ensure compensation arrangements comply with the Stark Law and the Anti-Kickback Statute, including their commercial reasonableness requirements, and any other regulations governing transactions in the healthcare industry. We bring clarity and up-to-date insight to your particular opportunities and challenges relating to both non-profit and proprietary healthcare. Our professionals are client-focused, helping organizations and individuals create strategies that can strengthen their financial positions.

If you have any questions about the relocation tax reform, the TCJA, or any other matter involving compliance or valuation, contact a PYA executive below at (800) 270-9629.

1 Per Section 132(g)(2) of Section 11048(a) of the Tax Cuts and Jobs Act, Pub. L. No. 115-97, 131 Stat. 2054, 2088 (2017).

2 There is an exception for active duty members of the United States Armed Forces who move pursuant to a military order or permanent change of station.

3 The MGMA Physician Placement Survey provides comparison data on provider placements from independent recruiting firms and healthcare organizations with employed recruitment staff. The 2018 report includes data from 1,198 groups and 8,958 providers. The data is proprietary and owned by MGMA.

4 Merritt Hawkins is a national healthcare search and consulting firm. The 2018 Review of Physician and Advanced Practitioner Recruiting Incentives is the 25th annual review conducted by the firm. The 2018 review is based on 3,045 permanent physician and advanced practitioner search assignments that Merritt Hawkins and AMN Healthcare’s sister physician staffing companies (Kendal & Davis and Staff Care) had ongoing, or were engaged to conduct, during the 12-month period from April 1, 2017, to March 31, 2018.

5 SullivanCotter is a human resources management consulting firm. The 2018 report is the 26th annual report on physician compensation published by the firm and contains data from 749 healthcare organizations. It reports total cash compensation levels paid to 167,383 incumbents.

© 2019 PYA

No portion of this article may be used or duplicated by any person or entity for any purpose without the express written permission of PYA.