The recently enacted Coronavirus Aid, Relief, and Economic Security Act (CARES Act) is an extremely comprehensive relief package designed to help Americans weather the COVID-19 storm through cash infusions, cost savings, and deferral opportunities. One of the most highly publicized components of the CARES Act is the Payroll Protection Program (PPP) loan. This legislation also includes an opportunity for employers to defer portions of their payroll tax payments to future years. Recently, questions have surfaced about which payments qualify for deferral, and the difference in the criteria used for employers that receive PPP loan funding and those that do not.

The following insight from PYA is aimed at helping you navigate the interaction between these two programs.

The big question–Can I participate in both programs?

The CARES Act does allow for participation in both programs. However, the deferral option is limited for those employers that are also PPP loan participants.

How does the deferral program work, generally?

The program allows employers to defer the employer’s share of Social Security taxes (6.2% of compensation) for payments required to be made between March 27, 2020, and December 31, 2020. According to Internal Revenue Service (IRS) guidance, employers will not be required to make any special election for these deferrals, and no failure to deposit or pay penalties will apply to amounts deferred. IRS Form 941, Employer’s Quarterly Federal Tax Return, will be revised for the second calendar quarter of 2020 (April – June 2020) to facilitate making these deferrals. Any payroll taxes deferred must be paid back in two equal installments–one no later than December 31, 2021, and the other no later than December 31, 2022.

How is the deferral program limited for PPP Loan participants?

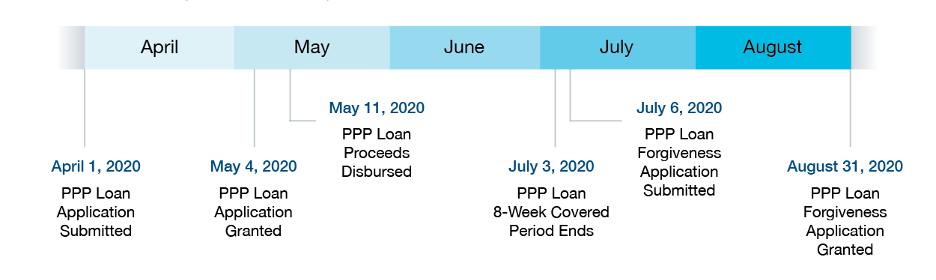

PPP Loan participants are only eligible to defer these payroll tax payments until a determination is made by the Small Business Administration (SBA) about loan forgiveness. Let’s look at a typical PPP Loan timeline:

Based on available guidance, all of the employer’s share of Social Security taxes from March 27 through the loan forgiveness date of August 31 are eligible for deferral.

Other Questions to Consider:

How does the deferral interact with the paid leave credits under the Families First Coronavirus Response Act (FFCRA)?

According to IRS guidance, an employer should calculate the deferral amount prior to determining its entitlement to the paid leave credits under Sections 7001 or 7003 of FFCRA, or the employee retention credit under Section 2301 of the CARES Act, and prior to determining the amount of (a) employment tax deposits that it may retain in anticipation of these credits, (b) any advance payments of these credits, or (c) any refunds with respect to these credits.

If some portion of the PPP Loan is not forgiven, can the employer continue to defer some portion of its share of Social Security taxes?

If any portion of the loan is forgiven, the employer is no longer eligible to defer its share of Social Security taxes. However, if the employer’s circumstances lead to a complete denial of loan forgiveness, it appears that the statute allows for continued deferral through the end of the year.

Unanswered Question:

The biggest unanswered question relates to those taxpayers who previously deposited some portion of their share of Social Security taxes that were eligible for deferral. Those employers required to pay their deposits more frequently are more likely to find themselves in this circumstance. Will there be any opportunity to have those payments refunded, or have future deposits adjusted for missed opportunities for allowable deferrals? Unfortunately, we will need to wait for further guidance before gaining clarity on this issue.

Should you have questions about any of this information or need additional COVID-19 guidance, visit PYA’s COVID-19 hub, or contact one of our PYA executives below at (800) 270-9629.