Owning a small business often involves using personal resources for business purposes, such as driving personal vehicles. Luckily, there is a tax deduction available for the expenses involved with business-purpose vehicle use.

The deduction is calculated either by the standard mileage rate or by actual expenses. The first and more straight-forward method is the standard mileage rate method. This method calculates your deduction by multiplying total business miles driven during the year by a standard mileage rate. The standard mileage rate is set annually by the Internal Revenue Service (IRS). For 2015, that rate is 57.5 cents per mile driven. The biggest advantage this method offers is ease of recordkeeping, since you only will need to keep up with miles driven for business reasons during the year.

Alternatively, the actual expense method allows a deduction for total vehicle costs incurred throughout the year, adjusted for business-use percentage. These costs include many items such as cleaning, gas, maintenance, insurance, tires, repairs, licenses, and registration. Once you have total vehicle costs, these costs will then need to be adjusted for business-use percentage. For example, if you use your vehicle 50% of the time for personal and 50% of the time for business, you would only deduct half of all vehicle costs.

In addition, the actual expense method allows businesses to write off the cost of the vehicle itself through depreciation. Similarly, the depreciation deduction must be adjusted for the vehicle’s business usage. For example, if a car costs $50,000 and it is used for business 50% of the time, the depreciation is computed based on the business-use percentage only.

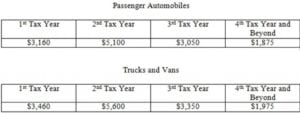

However, it is important to note the IRS limits the annual depreciation deduction for passenger automobiles. These limitations are set dollar amounts and are adjusted on an annual basis to account for inflation. Below are the newly released 2015 limits.

Bonus depreciation has yet to be extended into the 2015 tax year, but if it is available for 2015, it would increase the first-year limit by $8,000. Meaning that in the first year, the depreciation deduction for a passenger automobile could be up to $11,160 ($3,160 + $8,000) assuming it is used for business 100% of the time.

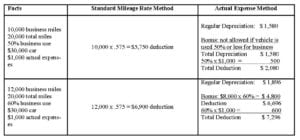

So which method should you use? The most important factor in making this decision is the cost of operating your vehicle. If the costs of operating your vehicle are high, the standard mileage rate method may produce a smaller deduction than would be obtained by claiming actual expenses plus depreciation.

The calculations below show that a slight change in facts will result in the selection of a different method:

If you have questions about the business use of your automobile and the optimal method for deducting the expenses related to its use, contact the expert listed below at PYA, (800) 270-9629.